The Raspberry Pi Foundation has become a public company on the London Stock Exchange and is a public company. What happened?

Why go Public?

If you’ve followed our articles about the Raspberry Pi 5, then you’ve probably seen that the Raspberry Pi 5 development cost millions. This was especially the case because the foundation decided to develop a custom I/O device that was custom made to the needs of Raspberry Pi computers.

That large amount of investment means that RPI foundation is having to invest more in order to continue to capture more market share and meet consumer needs. Going to the market to IPO is an obvious way to help raise significant amount of money.

In its announcement of the IPO, the foundation states that “the money raised by the Raspberry Pi Foundation in the IPO will support its ambitions for global impact in its second decade”.

In another blog post, we get some more details:

“As the company has continued to grow, it has needed working capital and funding to invest in innovation and product development”

This is clear confirmation that They need a lot more cash in order to fund future designs. But the Foundation also wants to do this sustainably. The revenue likely wasn’t enough to fund both designs and the foundation at the same time.

Financials

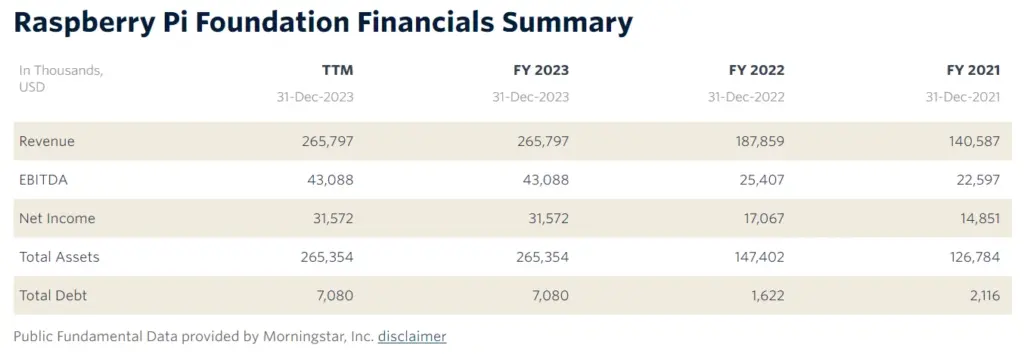

One of the advantages of looking at a public company is that many of its financial metrics become public. The financial table above shows quite a bit of information about Raspberry Pi’s financials. Overall the company is doing quite well, which matches with what we’ve seen from the popularity of the Raspberry Pi.

The company had $265M in revenues for 2023, and made about $31M in net income, about 11%. This is how much is left even after taxes and everything else is taken out.

When you look at the total debt, it’s about $7M, which is easily covered by the net income. Clearly they are not in debt and are profitable, which aligns with the money from the IPO coming in to fund future growth as opposed to trying to pay down debt or something else.

Raspberry Pi shares are currently trading at around £419 per share, giving the company a market capitalization of £783.33m. That’s quite a large number and represents about 3x their revenue and 8.5x net income.

To put it in perspective – in about 8.5 years they could buy themselves. Not too shabby.

Conclusion

Since its inception in 2008, the Raspberry Pi Foundation has grown amazingly (and profitably). To keep fueling that expansion, they’ve gone public, which means now people can buy not only Raspberry Pi boards, but also the stock.